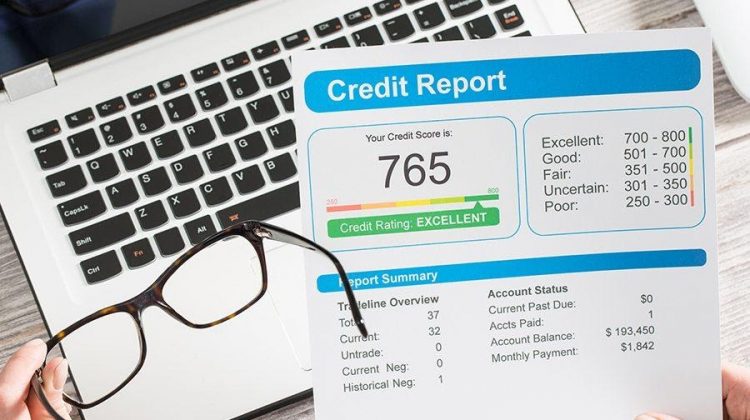

When you are a business owner, it is best to keep an eye on your business credit score. This is because when you apply for credit cards or loans, lenders will always consider your business credit score. The credit score helps them to know how much risk your business poses, and they also learn your financial behavior.

5 Basics to Know About Business Credit Scores

Interestingly, many business owners are not aware that these reports are there, and they impact their business financial life in a great way. Below are some of the basics to know about business credit scores.

1.Understanding your business credit score matters

If your business needs business credit products such as financing, it is vital to know why your business credit score matters. Plus, it is important to make it a priority to have a healthy business credit profile. In case it is a challenge, you can check with companies that help build business credit as they will come in handy to help improve your business score. Since most businesses at one point will need credit. Whether you are a marketing professional, a carpenter, a salon owner, and you need to grow and expand your business, you will benefit from getting business credit. Because of this, your business credit score matters if you want your business to grow.

2.The line between business and personal credit scores

There is a difference between these two credit scores. That is, there is no law governing business credit reports. Hence, anyone with or without your permission can access your business credit information. Plus, you are not allowed to freeze your business credit report. Does one credit report affect the other? It depends as most business loans and credit cards require a personal guarantee. Thus, if you default on an account, your personal assets and credit will take a hit.

3.Business credit score factors

To know how high or how low your business credit score can get there are factors to determine. For instance, the business size, industry norms, credit utilization, credit mix, payment history, and some other factors determine and are similar for personal credit scores. Even where the scoring ranges of agencies look similar, they always collect different sets of data, and each has a specific process for calculating your score. Importantly, business credit reports show when you make your payments and also whether you pay them early. Also, you can pay before your bill arrives to improve your score, and you can use this as leverage for better terms.

4.Know how to improve your business credit scores

If you are aiming to improve your business credit score. First, you will have to establish a business credit file. Once your credit file exists, you can now boost your business credit score. Firstly, build your payment history by establishing accounts that report to the credit bureaus. As for major lenders and banks always report, but for other vendors, you can ask them directly. Where you are struggling to improve your credit score.

5.How to handle a bad business score

Before you seek business credit, you need to be aware of your credit standing. Building your credit score and history takes time. What if your business credit score is not at par? Thus, you can check for errors and address them no matter how insignificant they affect your business score. Also, ensure that you keep utilization low and pay on time. Since not all low scores are due to errors, it may be your payment history as well. Consistently, be smart with credit, for, with most accounts, you will have to provide a personal guarantee. Also, try to separate your personal credit from your business credit to protect your personal score in case you face financial challenges.

Conclusion | 5 Basics to Know About Business Credit Scores

To conclude, when your business has a business credit card, you already know you have business credit scores as well. The credit scores are beneficial to help you secure better terms when you apply for a loan or as you get insurance for your business. Therefore, it is vital to be familiar with the above basics. Since a lot of business owners are not familiar with business credit scores and do not know where to find them or how to improve them for the benefit of their business.